The digital finance landscape has evolved rapidly, making cryptocurrency accessible to a wider audience than ever before. As more individuals look to diversify their financial activities, the need to buy crypto exchange-wise through secure and transparent platforms has become essential. Choosing the right environment for cryptocurrency transactions is not only about convenience but also about safety, control, and clarity.

For first-time users and experienced participants alike, understanding how a simple crypto exchange operates can reduce risks and improve confidence. Secure platforms focus on compliance, user education, and technical safeguards, ensuring that cryptocurrency transactions remain reliable from start to finish. This article explores how such platforms function, what features matter most, and how users can make informed decisions without relying on brand-specific solutions.

Understanding Crypto Exchange-Wise Transactions

Buying crypto exchange-wise means using a structured digital platform that connects buyers and sellers under defined rules. These platforms act as intermediaries, ensuring that cryptocurrency transactions follow proper verification and settlement processes.

Unlike informal or peer-only methods, exchange-based transactions introduce standardized pricing mechanisms, order matching, and record keeping. This structure helps users track activity clearly while reducing exposure to manipulation or errors.

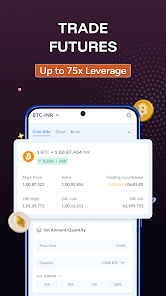

A simple crypto exchange prioritizes ease of navigation and clarity. Users can review prices, place orders, and monitor balances without complex steps. This approach supports informed participation, especially for those new to cryptocurrency markets.

Why Security Is Central to Crypto Exchanges

Security is a core requirement when dealing with digital assets. Since cryptocurrency exists electronically, secure platforms must protect both transaction data and stored assets from unauthorized access.

Key Security Layers Used by Exchanges

Secure platforms implement multiple layers of protection to safeguard users. These include identity verification, encrypted communication, and controlled access to digital wallets. Each layer plays a role in reducing vulnerabilities and preventing misuse.

In addition, exchanges often separate operational funds from user holdings. This structure limits exposure during unexpected events and improves overall reliability. Users benefit from systems that are built with risk management as a foundation rather than an afterthought.

Features That Define a Simple Crypto Exchange

A simple crypto exchange does not mean limited functionality. Instead, it focuses on usability while maintaining necessary controls. Such platforms are designed to support smooth navigation without overwhelming users.

User Interface and Navigation

Clear menus, readable charts, and guided steps make it easier to buy crypto exchange-wise. Platforms that reduce unnecessary complexity allow users to focus on decision-making rather than technical adjustments.

Transparent Fee Structures

Hidden costs can confuse users and affect trust. Secure exchanges display transaction fees clearly before confirmation. Transparency ensures that users understand how much cryptocurrency they receive and what costs are involved.

Educational Support

Many users entering cryptocurrency markets require guidance. Platforms that offer explanations, usage tips, and basic learning resources help users understand risks and responsibilities without relying on external sources.

Compliance and Regulatory Alignment

Compliance plays a major role in the reliability of cryptocurrency platforms. Secure exchanges align with applicable regulations to ensure lawful operations and user accountability.

Identity verification procedures are often part of this alignment. While some users may find verification time-consuming, it contributes to fraud prevention and long-term platform stability. Compliance also supports dispute resolution and accountability, which are essential in digital finance.

By choosing regulated environments, users gain additional confidence when they buy crypto exchange-wise, knowing that the platform operates under defined legal frameworks.

How Exchanges Protect Cryptocurrency Assets

Cryptocurrency storage is as important as transaction execution. Secure platforms use controlled storage methods to reduce exposure to online threats.

Wallet Management Practices

Exchanges often maintain separate systems for daily operations and long-term asset storage. This separation limits access points and reduces potential attack surfaces.

Continuous Monitoring

Ongoing monitoring helps detect unusual activity early. Platforms that track transaction behavior can respond quickly to potential issues, protecting users before losses occur.

These practices ensure that cryptocurrency assets remain protected even during periods of high activity or market volatility.

Risk Awareness for Users

Even with secure systems, users must understand that cryptocurrency involves market risk. Prices can change rapidly, and no platform can eliminate this aspect entirely.

A simple crypto exchange supports risk awareness by offering clear transaction summaries and real-time pricing data. When users can see accurate information before confirming actions, they are better positioned to make informed choices.

Risk awareness also includes understanding personal limits and avoiding impulsive decisions. Secure platforms encourage responsible usage by focusing on clarity rather than urgency.

The Role of Transparency in Exchange Trust

Transparency builds long-term trust between users and platforms. Secure exchanges provide access to transaction history, account activity logs, and balance updates without delays.

This openness allows users to verify every step of their cryptocurrency journey. When information is readily available, confidence increases and misunderstandings decrease.

Transparency also supports accountability, ensuring that users can review past actions and identify discrepancies if they arise.

Choosing the Right Platform to Buy Crypto Exchange-Wise

Selecting a platform should be based on structure, security, and usability rather than popularity. Users should evaluate how well a platform explains its processes and how clearly it presents essential information.

A reliable exchange balances simplicity with safeguards. It avoids unnecessary features while ensuring that core functions operate smoothly. By focusing on secure design and user education, platforms help individuals engage with cryptocurrency responsibly.

Conclusion

As interest in digital assets continues to grow, the ability to buy crypto exchange-wise through secure systems becomes increasingly important. A well-designed platform combines safety, transparency, and usability without relying on complexity or promotion.

Cryptocurrency participation is most effective when users understand how exchanges work and what protections are in place. Choosing a simple crypto exchange allows individuals to focus on informed decision-making while minimizing unnecessary risks.

By prioritizing secure practices, clear information, and responsible access, users can engage with cryptocurrency confidently and sustainably in an evolving digital economy.