In the rapidly changing world of finance, stock market investing calls for more than just money—it requires convenience, safety, and speed. A Demat account serves as a secure digital repository for your securities, making it a vital tool for modern investors. As digital platforms continue to grow, choosing a Demat account that aligns with your financial goals has become more important than ever.

Whether you’re a beginner or an experienced investor, a good share market app or mobile trading app can simplify your trading journey. This article explores the essential ideas to help you select a top Demat account and how it fits into your smart investing strategy.

Understanding the Role of a Demat Account

A Demat account, or dematerialized account, is used to hold shares and securities in electronic form. It eliminates the need for physical share certificates, reducing paperwork and making transactions more secure and faster.

When you buy stocks, they get credited to your Demat account. When you sell them, they’re debited. This process ensures transparency and ease of tracking your portfolio. The right account can significantly improve your trading experience, especially when integrated with a mobile trading app.

Why Smart Investors Prioritize Demat Account Features

1. Ease of Access and Trading

Modern investors prefer platforms that offer seamless access via a share market app. A user-friendly interface, fast load times, and real-time updates are non-negotiable. Being able to execute trades, track holdings, and manage funds from your smartphone makes the investment process efficient.

2. Security of Digital Assets

Cybersecurity is a crucial concern for smart investors. A reliable Demat account provider ensures encryption, two-factor authentication, and secure login protocols. This protects your holdings and personal data from unauthorized access.

3. Low Account Maintenance Fees

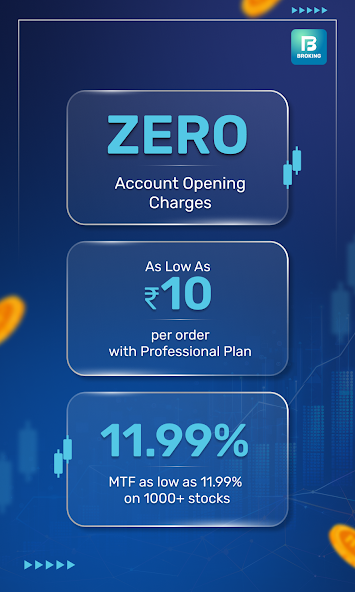

Many investors opt for accounts with minimal or no annual maintenance charges. Low fees mean better profitability, especially for long-term holders or those investing in small amounts regularly.

Key Elements to Evaluate in a Demat Account

Hassle-Free Onboarding Process

Smart investing starts with a smooth account opening experience. The ideal Demat account allows for quick online registration with digital KYC. This saves time and eliminates the need for in-person verification.

Real-Time Data and Analytics

Access to real-time market data, live charts, and financial analysis tools directly in your share market app gives investors an edge. These tools support better decisions by helping you evaluate market trends, stock movements, and sector performance.

Integration with Trading Accounts

A well-integrated Demat and trading account provides a consolidated view of your investments. It simplifies buying/selling of securities and reduces transactional delays. Ensure the platform offers instant fund transfers and real-time order execution.

Flexible Investment Options

Top Demat accounts allow you to invest in more than just equities. Look for platforms that support bonds, ETFs, government securities, and mutual funds. A diversified portfolio spreads risk and aligns with smart investing principles.

Best Practices for Using a Demat Account Wisely

Monitor and Review Regularly

Keep a close eye on your holdings. Use your mobile trading app to check performance, rebalance your portfolio, and stay updated on corporate actions like dividends, splits, and rights issues.

Avoid Overtrading

Frequent buying and selling can erode gains through transaction fees. Instead, adopt a strategic approach—invest based on long-term goals and avoid impulsive trades influenced by short-term market noise.

Stay Updated on Regulatory Changes

Smart investors always stay informed about changes in trading regulations or Demat account rules. This awareness helps avoid penalties and ensures compliance with legal frameworks.

Common Mistakes to Avoid with Demat Accounts

- Ignoring Hidden Charges: Some accounts may have hidden fees for transactions, SMS alerts, or conversion charges. Always review the fee structure in detail.

- Not Linking a Bank Account Properly: Improper linking can delay fund settlements or create issues during withdrawals.

- Neglecting Account Inactivity: An inactive account for long periods may attract charges. Use your account periodically or close it if not needed.

Mobile Trading App: A Tool for Smarter Decisions

The rise of mobile-first investing has transformed how Demat accounts are used. Today’s mobile trading apps offer:

- Real-time price alerts and news updates.

- Advanced technical and fundamental analysis tools.

- Seamless execution of buy/sell orders.

- Access to IPOs and new investment products.

These tools empower investors to react quickly to market changes, making it easier to seize opportunities or limit losses.

Share Market App: Your Gateway to Investing

A dedicated share market app linked to your Demat account is more than just a trading interface—it’s a gateway to research, strategy, and financial discipline. It helps:

- Manage all types of securities in one place.

- Analyze your asset allocation with visual dashboards.

- Stay on top of market sentiments and trends.

Using such apps ensures you remain informed and aligned with your financial goals.

Conclusion: Choosing a Top Demat Account for Smart Investing

Choosing the right Demat account requires a thoughtful approach. Evaluate features like platform usability, security, charges, and product offerings. When paired with an intelligent share market app and an efficient mobile trading app, your Demat account becomes a powerful tool in your investment journey.

Smart investing is not just about selecting stocks—it’s about creating a system where every element, including your Demat account, adds value. Stay informed, invest wisely, and leverage technology to make better financial decisions.