Financial needs are rarely timely. An unexpected bill, medical emergency, household maintenance, or vacation can necessitate fast financing. Banks provided personal loans for years, but documentation and approval procedures were lengthy. This is impractical in today’s fast-paced environment. Digital lending options like money loan apps are essential to daily living.

A money loan app makes borrowing money fast and easy without long waits. Instant loans, cash loans, and specialized apps like personal loan online and EMI loans assist people in managing short-term and long-term financial obligations.

Why Instant Loan Apps Are Popular

One of the biggest digital lending categories is the instant loan app. Like its name, it provides rapid cash aid. The approval procedure is quick and usually simply requires identity, bank, and income verification.

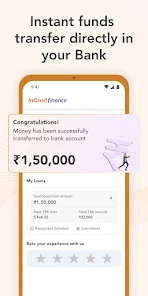

For medical emergencies, last-minute trips, or essential repairs, an immediate lending app can be lifesaving. The money is deposited into the borrower’s account within hours, unlike traditional loans. This speed makes it a reliable option for individuals who cannot wait.

Convenience of Cash Loan Apps

For daily financial demands, a cash loan app is reliable. Borrowers receive lower sums for domestic bills, groceries, and short trips. Cash lending apps are ideal for folks who need small loans but need them quickly.

These apps are used by professionals and freelancers for short-term needs. Since cash loan app repayment durations are flexible, they can replace monthly budget shortages without long-term financial stress.

Larger Expense – Personal Loan Online Apps

An unsecured loan through a personal loan online app is best for larger needs like education, wedding planning, or house maintenance. Personal loan apps have higher loan limits and longer repayment periods than cash loan apps.

Accessibility is its benefit. A personal loan internet software lets borrowers avoid bank visits and finish the transaction online. From application to approval and disbursal, the app does everything. This simplicity makes personal loan apps essential for busy students and professionals.

Loan Apps and Installment Repayment Power

Most borrowers worry about repayment. For salaried workers and low-income students, repaying a loan all at once is challenging. An EMI loan app is quite beneficial here.

An EMI loan app lets borrowers pay monthly installments. Automatic deductions ensure regular payments without stress. This structure simplifies budgeting and builds credit. EMIs make borrowing easier and cheaper for technology, education, and medical expenditures.

Loan Apps Build Financial Discipline

A money-lending app provides fast funding, but financial discipline is often disregarded. Repayment plans, reminders, and spending tracking apps are common. Borrowers learn their financial obligations by using immediate or EMI loan apps.

Young professionals and students starting to manage money independently benefit from this subject. They develop good financial habits by borrowing responsibly and paying on time.

Conclusion

Not everyone has the savings to handle sudden financial emergencies. Money lending apps cover this gap with fast, flexible, and secure borrowing. These digital platforms make financial support accessible to anyone through rapid loan apps for crises, cash loan apps for modest needs, personal loan online apps for larger bills, and EMI loan apps for manageable repayments.

Money lending applications are now vital tools in a world where time is scarce and bills are unpredictable. By offering speed, simplicity, and security, they allow people to manage their finances and handle unanticipated demands.